Smart Locker Market Analysis

In today’s world of business, the efficient and rapid delivery of products to customers, also known as last-mile logistics, has become extremely important.

This report presents a comprehensive analysis of the worldwide smart last-mile logistics industry.

It involves market evaluations, landscape analysis, and detailed case studies of different countries, all aimed at revealing strategic insights for industry players.

Smart Last-Mile Logistics Market Assessment Model

A variety of indicators are utilized to assess market attractiveness and maturity.

Target Markets:

- Europe (Belgium, Bulgaria, Denmark, Estonia, Finland, France, Germany, Great Britain, Italy, Netherlands, Poland, Romania, Spain, Sweden)

- Asia (China, Indonesia, Japan, Malaysia, Singapore, Vietnam)

- Americas (Brazil, USA)

Rationale

Market Attractiveness

-

- Political Perspective: Degree of policy support

- Economic Perspective: National economic situation (GDP per capita), retail market size, e-commerce penetration, logistics market scale

- Social-Cultural Perspective: Infrastructure, logistics development level, population density, self-pickup preference

- Technological Perspective: Level of technology

Market Maturity

-

- Maturity of smart last-mile delivery application: Number of smart locker banks/smart PUDOs per million parcels, number of smart last-mile stations covered per million people, scale of unmanned delivery vehicles

This assessment provides clear insights into the smart last-mile logistics sector, enabling stakeholders to make informed decisions and seize opportunities.

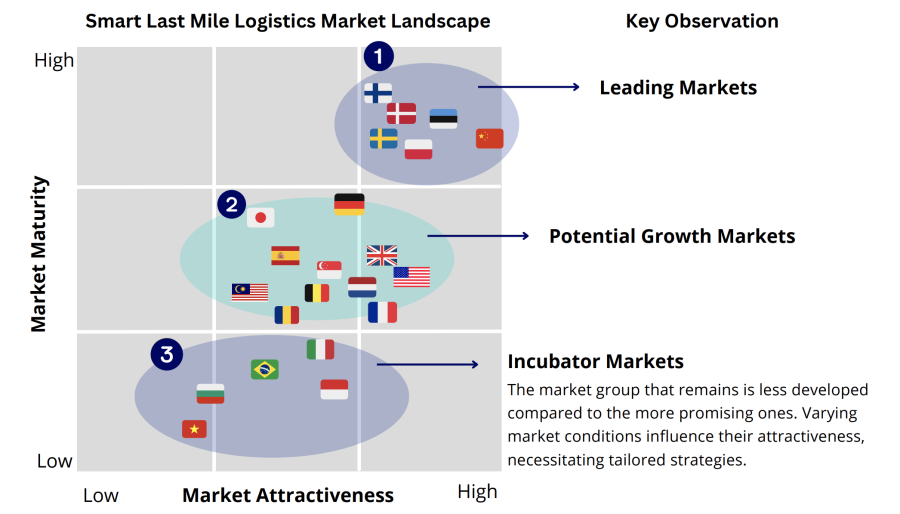

Smart Last-Mile Logistics Market Landscape

Source: Deloitte analysis, Cainiao Research Center

The analysis goes beyond mere assessment to segment markets based on maturity and attractiveness and aims to aid in identifying strategic entry and intensity for distinct market groups.

Segmentation of Market Groups

Key Benchmark Markets

Countries like China, Denmark, Estonia, Finland, Poland, and Sweden exhibit both attractiveness and maturity in the smart last-mile logistics sector.

These benchmark markets serve as references for tech advancements and business models in other markets

Potential Growth Markets

The high development attractiveness of moderate market maturity regions in Western Europe, Southern Europe, Southeast Asia, and others is key to substantial growth potential and requires strategic attention.

Sub-potential Incubator Markets

These markets have lower overall maturity compared to benchmark and potential growth markets.

Nevertheless, their attractiveness varies based on specific market conditions, allowing for targeted approaches.

Analysis of Representative Countries and Their Smart Last-Mile Solutions

China

China, a beacon of technological innovation, has been strategically advancing its digital economy, particularly in the realm of smart last-mile logistics. The commitment to this endeavor has propelled remarkable advancements, reshaping the landscape of last-mile delivery in profound ways.

Rapid Expansion and Market Leadership

With a staggering surge in e-commerce transactions, China’s parcel delivery industry has experienced unprecedented growth.

In 2022 alone, e-commerce transactions reached an astounding RMB 43.83 trillion, fostering a robust ecosystem for last-mile logistics.

The parcel delivery volume soared to 110.58 billion packages, demonstrating a 2.1% increase year-on-year, underlining China’s dominance in the global logistics arena.

Innovative Solutions Shaping the Future

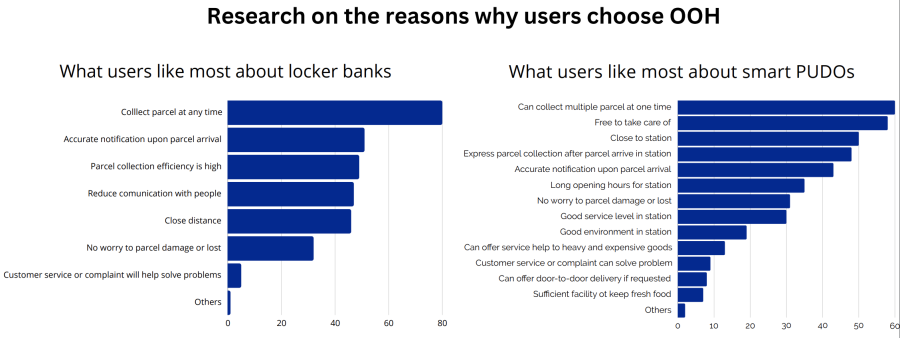

Source: Cainiao’s users and business research

Innovative solutions redefining traditional delivery methods are key to China’s last-mile logistics prowess.

Smart locker banks, unmanned vehicles, and drones have emerged as pivotal tools revolutionizing the industry.

These technologies, driven by e-commerce giants, logistics firms, and third-party entities, have propelled China to the forefront of smart last-mile logistics globally

Embracing Technological Advancements

China’s infrastructure, coupled with widespread consumer acceptance, has laid a solid foundation for the adoption of cutting-edge technologies.

Smart locker banks, led by SF’s Hive Box, capturing a staggering 70% market share, have become ubiquitous, offering convenient and secure parcel collection points.

Moreover, Cainiao’s “Xiaomanlv” unmanned delivery vehicle, with its monumental achievement of delivering over 20 million orders during the “Double 11” event in 2022, showcases the rapid scalability and adoption of unmanned delivery solutions in China.

Key Data:

- China’s retail sales surged to about CNY 44 trillion in 2022, showing massive market potential

- China is the largest e-commerce market in the world, with sales expected to reach $3.56 trillion by 2024, boosting demand for efficient last-mile delivery

- Parcel volume in China hit 108 billion in 2021, a substantial 30% yearly increase, cementing its global logistics dominance

- China handles 120 billion parcels in 2023

- China sees over 4,000 parcels generated every second, totaling more than 350 million daily, with each person receiving over 90 parcels annually

Poland

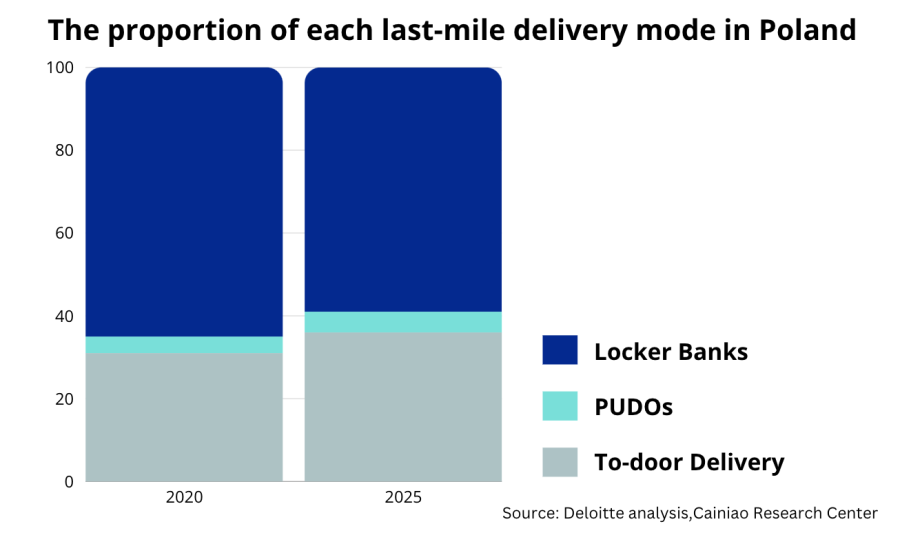

Poland’s e-commerce sector growth has driven the rapid expansion of smart last-mile logistics, particularly in smart locker banks.

Polish consumers generally prefer self-pickup options, contributing to the market’s growth.

Market Growth and Projections:

Recent research suggests that Poland’s parcels market could surge to 1.31 billion parcels by 2023, driven by emerging leaders like InPost and shifts away from traditional carriers.

Our experience working with Polish Post, in particular, has given us insight into this shift.

The country’s rapid e-commerce expansion has propelled it to the forefront of out-of-home (OOH) delivery, particularly through smart locker banks and pick-up/drop-off points (PUDOs).

Innovation Driving Market Dynamics:

Poland’s leading-edge approach to delivery is not solely attributed to growth but also to a demand for capacity and consumer-centric services.

The market’s dynamism stems from the need to meet evolving consumer expectations for flexible last-mile services, making it one of Europe’s most vibrant markets in this domain.

Impact of Global Players:

Anticipation of Amazon’s entry into the Polish market has spurred local players, notably InPost, to adopt innovative strategies. Drawing inspiration from e-commerce giants, local companies are driving innovation, making Poland’s CEP market one of the most dynamic in Europe.

Key Data:

- E-commerce retail sales in Poland exceeded PLN 100 billion in 2021 and increased on average by 28.1% per year (CAGR)

- In Poland, self-pickup options, especially lockers, are favored, with up to 31% of the market in 2020, and are expected to reach 36% by 2025

- Polish parcel volume reached 986 million in 2021, up from 813 million in 2020

- Poland is among Europe’s fastest-growing out-of-home (OOH) delivery markets, with PUDO points increasing by over 70%.

- Locker bank volume in Poland exceeded 20,000 in 2021, making it the largest market in Europe

Singapore

Singapore, a prominent Southeast Asian city-state, boasts a thriving economy and advanced infrastructure.

The market’s high population density and GDP per capita position it favorably for the smart last-mile logistics development.

Singapore’s smart last-mile logistics market is characterized by state-owned enterprises dominating the landscape.

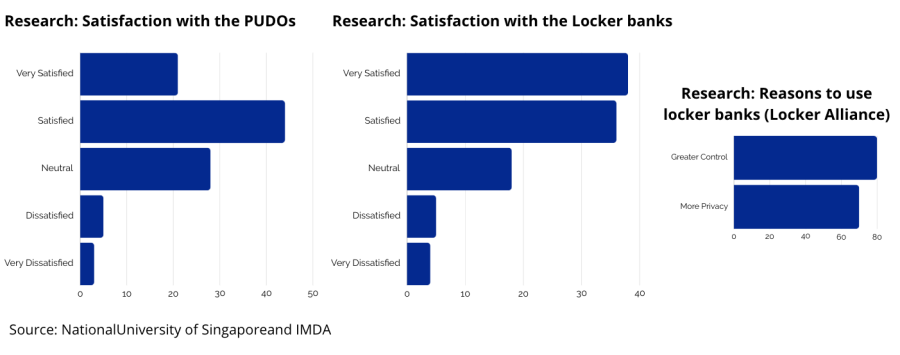

Despite technological advancements, locker bank adoption rates remain modest due to convenience and pricing factors.

However, the market holds promise for future growth driven by economic development and environmental awareness.

Market Trends & Analysis:

Singapore’s last-mile delivery market is valued at about USD 28 Billion and is expected to record a CAGR of more than 8% during the forecast period.

- Growth in E-commerce Driving the Market: Singapore’s robust e-commerce growth is propelling the expansion of last-mile delivery services, with projections indicating significant market size increases by 2027.

- Increase in Cross-Border Shopping: Cross-border e-commerce is on the rise in Singapore, with better prices and product variety driving consumer behavior.

Last Mile Delivery Industry Overview:

Singapore’s Last Mile Delivery Market is fairly fragmented, with a mix of global and local players, making the sector highly competitive.

Some of the strong players in the country include DB Schenker, Singapore Post, Deutsche Post, DHL Logistics, UPS Singapore, and FedEx, among others.

Companies in the industry are concentrating on growing in terms of incorporating new technologies like drones, electronic vehicles, transport management systems, and artificial intelligence.

Key Data:

- The retail market in Singapore was approximately US$24,941.7 million in 2021

- E-commerce sales in Singapore are expected to reach USD 14 billion (SGD 19.6 billion) by 2027

- Estimated parcel volume in Singapore is around 260 million per year

Growth Market Case Study from France

Intermarché’s Last Mile Solution with Alfred24

Challenge

Intermarché faced rising delivery costs and increased demand for online shopping amid the Covid-19 pandemic.

Solution

Partnering with Alfred24, Intermarché installed chilled and frozen lockers across France to automate their Drive24 service. Alfred24’s software ensured compliance with cold chain regulations with remote monitoring capabilities. Despite challenges, Alfred24 provided support through remote installation guidance and training videos.

Outcome

The integration of temperature-controlled lockers slashed home delivery costs by an impressive 90% while rerouting over 18,000 deliveries to these lockers nationwide.

Key Takeaways

- Effective partnerships like Intermarché and Alfred24 are vital in addressing last-mile logistics challenges

- Technology and automation drive significant cost savings and efficiency gains

- Customizing solutions to meet regulatory requirements is crucial for success in last-mile delivery

- Adapting to changing consumer preferences enhances the overall shopping experience and boosts customer satisfaction

Incubator Case from Brazil

Challenge

Clique Retire noticed a lack of safe delivery services in Rio de Janeiro’s favelas due to high crime rates, affecting 1.5 million residents.

Solution

Teaming up with alfred24, they deployed smart parcel lockers across Rio, partnering with Rio Metro for installations. They developed secure, cost-effective lockers with CCTV and advertisement displays, integrated with alfred24’s LockerPro software for efficient parcel distribution.

Outcome

- Installed over 200 smart lockers in Rio and São Paulo.

- Revolutionized last-mile delivery for 45.3 million e-commerce users.

- Provided safe, reliable parcel delivery to underserved areas, positively impacting 1.5 million people.

Key Takeaways:

- Strategic partnerships and innovative technology can address last-mile logistics challenges effectively.

- Customized solutions tailored to local contexts drive success in diverse markets.

- Smart locker networks significantly enhance accessibility and convenience for consumers, fostering market growth and satisfaction.

Conclusion

The global smart last-mile logistics market offers endless opportunities for innovation and growth.

China is leading the way with its exceptional advancements, setting high standards for the sector worldwide.

Poland is effectively implementing smart locker solutions driven by strong consumer preferences for self-pickup options.

Meanwhile, Singapore has promising potential for growth, leveraging its advanced infrastructure and economic power.

As technology continues to advance and consumer demands shift, stakeholders in the smart last-mile logistics industry must remain adaptable. They must capitalize on emerging trends and growth opportunities to successfully navigate this dynamic market landscape.

Effective partnerships, technological innovations, and customization to meet regulatory requirements will be key drivers of success in this evolving industry.

Statistics Source: Deloitte 2023 Global Smart Last-Mile Logistics Outlook